Thank you for your interest in financial empowerment and financial wellness in Oregon. This quarterly newsletter highlights efforts statewide that are putting more Oregonians on the path to security, solvency, and success. Does your organization have news? Please let us know.

Investing in students: State Board guarantees personal finance class

Every Oregon school student will soon gain better skills and tools to build stronger financial security, thanks to a guaranteed personal finance class in high school.

At its final meeting of the 2023-2024 school year in June, the Oregon State Board of Education voted to adopt a new requirement that high school students take a standalone personal finance course before graduating. The course will be required for graduation starting in 2027, although districts can request a one-year delay. This decision was part of the statewide implementation of Senate Bill 3 (2023), which reinstates a dedicated financial learning requirement, after more than two decades without one.

The board also approved the wide-ranging topics that will be taught, including saving and debt, budgeting, taxes, and maintaining financial wellbeing.

State Treasurer Tobias Read, a nonvoting member of the state education board and Chair of the Oregon Financial Empowerment Advisory Team, supported the decision as an opportunity to help every Oregon student gain access to personal finance education.

“By prioritizing financial literacy in our schools today, we are building a more financially secure and responsible future in Oregon,” said Treasurer Read, who has made financial empowerment a cornerstone of his administration.

The State Board’s decision also was recognized by national experts.

“Research shows that taking a dedicated course in personal finance leads to better financial decisions and helps graduates begin adulthood on stronger financial footing,” said Nan J. Morrison, president and chief executive officer of the New York-based Council for Economic Education.

Training needs for Oregon educators to be discussed on Aug. 15

A new personal finance class requirement will soon benefit Oregon high schoolers.

Now, it’s time for educators and districts to start prepping.

How can Oregon help ensure that our vital educators are ready? And also, how can the state ensure teachers and districts aren’t overrun by an avalanche of curriculum sellers?

At its annual in-person meeting, set for Aug. 15, the Financial Empowerment Advisory Team will discuss the educator training landscape with the Oregon Department of Education and hear from personal finance instruction experts including the director of the Washington State Financial Education Public Private Partnership.

The public meeting also will include a roundtable with team members and a polling update for the next Financial Wellness Scorecard.

The public is invited to join the conversation.

New comic book steers car buyers in the right direction

OCJ celebrated the launch of a new comic book to help car buyers at an event in June (OCJ photo).

Oregon Consumer Justice wants to make sure Oregonians know what to do – and not do – when it comes to buying a used car.

At a launch party in June, the Portland nonprofit formally unveiled its first “Consumer Confidence Comics!” book, filled with practical car buying tips.

“Access to a vehicle can support and enhance our quality of life, but buying one can be tricky,” said communications director Michelle Luedke. A comic book is an innovative way to be informative, and the book also includes black-and-white sections for kids to color.

Oregon Consumer Justice partnered with Young Walgenkim, a consumer attorney and author, and local illustrator Audra McNamee. Visit OCJ to get a free copy of “Purchasing a used Car,” in English or Spanish.

AARP highlights scams at events across the state

Financial scammers are looking for victims and opportunities in every part of the state. However, these efforts are met with pushback thanks to AARP Oregon.

The non-profit offers frequent workshops in communities across Oregon, from Portland to Medford to Bend, with the goal of helping the public learn what to avoid.

“Everybody can be a victim,” said Bandana Shrestha, director of AARP Oregon and a member of the Financial Empowerment Advisory Team. “Scammers and unscrupulous bad actors are creative and use every opportunity to defraud people. Adults of all ages are scammed at about the same rate, however, on average older adults lose more money to scams than their younger counterparts.”

The free events have different names, like a “Scam Jam” in West Salem in March and a “Fraud Fighter” summit in Beaverton in June. On July 30, the public can go bowling with AARP in Medford to “Strike Out Fraud,” and a “Spotting Scams and Staying Safe” event will be in Bend on Sept.12.

The sessions are part of a statewide effort to push back against what can feel at times like an unstoppable epidemic – and to be more effective at spreading the word, and the nonprofit works with partners including the U.S. Federal Trade Association, state agencies and even local police and district attorney offices.

State of Oregon Happenings

New Consumer rights give Oregonians more control over personal data

Oregonians now benefit from a suite of new consumer privacy protections, which went into effect July 1.

Among those: Consumers can know the specific entities that receive their personal data, and can now edit any inaccuracies in that data.

The Oregon Consumer Privacy Act (OCPA) was recommended by the Attorney General’s Consumer Privacy Task Force, a group of over 150 experts and stakeholders who met for four years to study options for stronger data privacy rights, and was signed into law in 2023.

“As technology advances, our consumer protection laws must keep pace. The OCPA does just that— providing the gold standard in consumer privacy protections nationwide,” said Attorney General Ellen Rosenblum, in a news release.

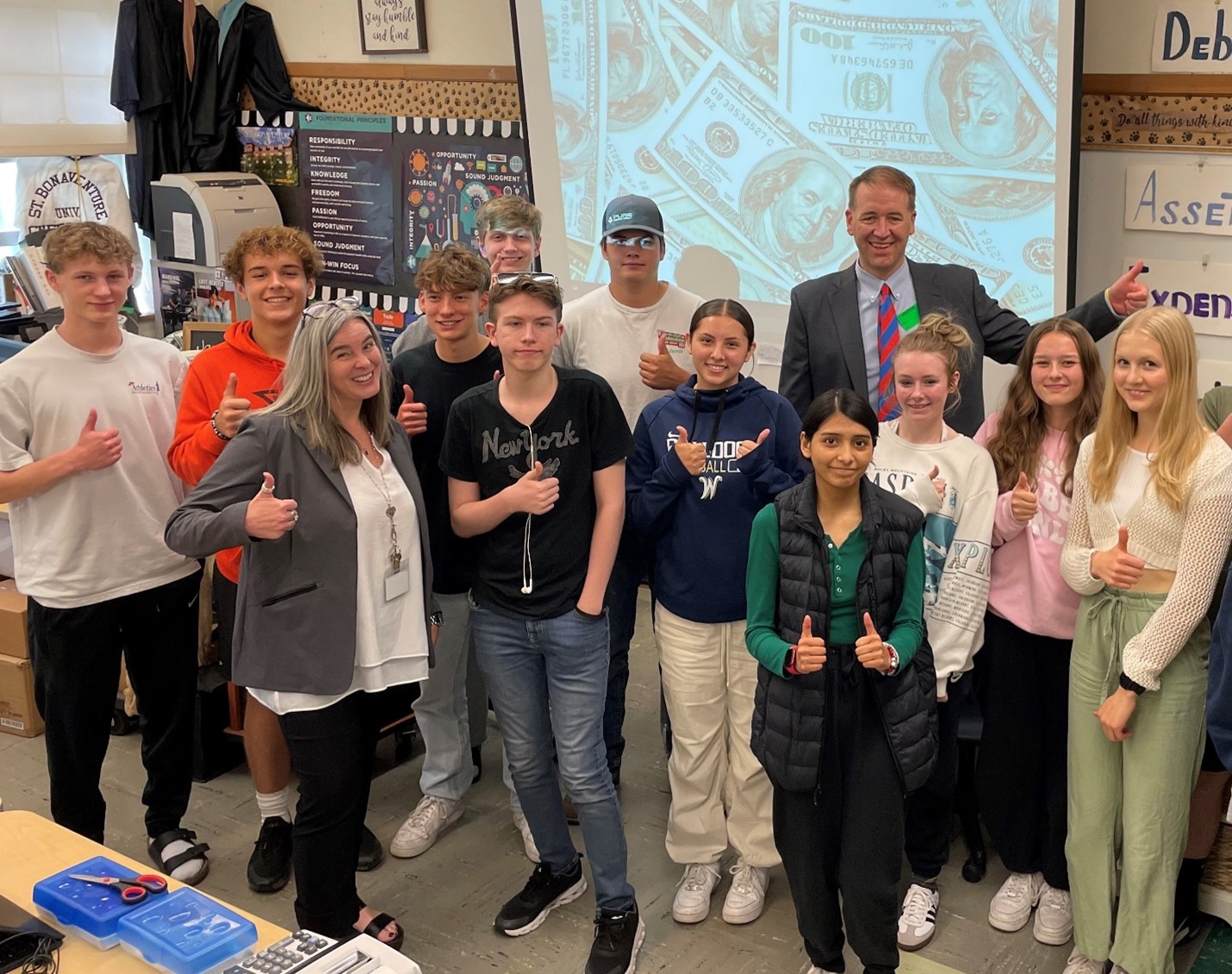

2024 Financial Empowerment Champions recognized for investing in Oregon kids

Treasurer Read presented the 2024 Financial Empowerment Educator of the Year award in June to West Albany business teacher Joey Running. (Treasury photo)

The winners of the 2024 Oregon Financial Empowerment Awards are West Albany High School business teacher Joey Running and the nonprofit Portland-based Oregon Business Academy, which connects students from across the state with an intensive weeklong business training camp.

The winners were announced during the April 2 meeting of the Oregon Financial Empowerment Advisory Team, as part of Treasury’s observance of Financial Literacy Month.

“In today’s society, financial literacy is a survival skill,” said Treasurer Read, the chair of the advisory team. “These financial empowerment heroes are helping Oregonians to develop tools to succeed -- and to know better what traps to avoid.”

Running, a business educator at West Albany High School, also was recently named the 2024 teacher of the year by the National Business Educators Association. Her 10 nominations came from students, peers, a state nonprofit leader, and the director of the national Jump$tart Coalition for Financial Education.

Oregon Business Academy organizes and stages a weeklong entrepreneurship camp, and fundraises for scholarships so low-income students can participate.

Entries will be accepted beginning in November 2024 for the 2025 awards.

Oregon Financial Empowerment Roundup

| Date |

Event |

July 25 |

Oregon financial education implementation webinar (SB3), 11 a.m., Oregon Department of Education, Zoom |

July 30 |

Strike Out Fraud, 11:30 a.m., AARP Oregon, Lava Lanes, Medford |

July 31 |

OregonSaves payroll webinar, English (9 a.m.) and Spanish (9:30 a.m.), Oregon State Treasury, WebEx |

Aug. 3 |

Fundaciones de Comprar Vivienda (Homebuying Foundations), 9 a.m., Dev NW, Zoom |

Aug. 5 |

Oregon financial education implementation webinar (SB3), 11 a.m., Oregon Department of Education, Zoom |

Aug. 8 |

OregonSaves employer webinar, English (9 a.m.) and Spanish (10 a.m.), Oregon State Treasury, WebEx |

Aug. 13 |

OregonSaves saver webinar, 2 p.m., Oregon State Treasury, WebEx |

Aug. 15 |

Financial Empowerment Advisory Team, 2 p.m., Oregon State Treasury, Tigard |

Aug. 27-29 |

Financial coach training, 9 a.m., $tand By Me Oregon/Oregon Cascades West Council of Governments, Corvallis |

Sept. 9 |

Financial Foundations, 5:30 p.m., DevNW, Mondays & Wednesdays, Linn Benton |

Sept. 12 |

Spotting Scams and Staying Safe, 2 p.m., AARP Oregon and partners, Larkspur Community Center, Bend |

Sept. 28 |

Homebuying Foundations, 9 a.m., DevNW, Lane County |

Oct. 15-16 |

RE: Conference, Neighborhood Partnerships, Salem Convention Center |

Oct. 16 |

Career and College Readiness ASPIRE Fall Conference, 9 a.m. Office of Community Colleges and Workforce Development, Eugene |

Oct. 16 |

Side Hustle workshop, 5:30 p.m., DevNW, Zoom |

Oct. 18 |

Career and College Readiness ASPIRE Fall Conference, 9 a.m. Office of Community Colleges and Workforce Development, Bend |

Oct. 23 |

Free Virtual Paying for College Night, 6 p.m., The College Place-Oregon, The Ford Family Foundation and the Oregon Association of Student Financial Aid Administrators, Zoom |

Nov. 12 |

Financial Empowerment Advisory Team, 2 p.m., Oregon State Treasury, Virtual meeting |