As a participant in the

Individual Account Program (IAP), you are automatically invested in the default IAP investment option, an age-based IAP target-date fund (TDF). Each September, you can choose your TDF for the upcoming year.

On this page

What Are target-date funds?

Which IAP TDF am I automatically invested in?

How can I confirm my current IAP TDF?

Can I change the IAP TDF in which I am invested?

When do I receive earnings for my IAP TDF?

Latest IAP earnings

What are target-date funds?

What is a target-date fund and how does it work? This

video explains how target-date funds make retirement investing easier.

Read more about the Oregon Investment Council's IAP investment strategy.

A target-date fund typically has a date in its name — this is called the fund’s “target date.” The target date is near when you turn 65, may expect to retire, and begin withdrawing from your account. A TDF adjusts its investments over time. If you are in your early working years, the emphasis of the fund is on growth, in order to build your retirement account balance. As you move toward retirement, the investments of the fund gradually evolve, becoming more conservative to help protect against market fluctuations — and the process happens automatically.

In 2018, you were placed into an IAP TDF based on the year you were born (see chart below). For more information about each of the IAP TDFs, including the TDF investment strategy, allocation, and other details about the Oregon Investment Council (OIC), go to the Oregon State Treasury’s

IAP website.

Which IAP TDF am I automatically invested in?

| Effective January 1, 2025 |

|---|

| Birth year | Name of target-date fund | Expected retirement date* range |

|---|

| In 1962 or earlier | Retirement Allocation Fund | 2027 or earlier |

| Between 1963 and 1967 | IAP 2030 Target-Date Fund | 2028-2032 |

| Between 1968 and 1972 | IAP 2035 Target-Date Fund | 2033-2037 |

| Between 1973 and 1977 | IAP 2040 Target-Date Fund | 2038-2042 |

| Between 1978 and 1982 | IAP 2045 Target-Date Fund | 2043-2047 |

| Between 1983 and 1987 | IAP 2050 Target-Date Fund | 2048-2052 |

| Between 1988 and 1992 | IAP 2055 Target-Date Fund | 2053-2057 |

| Between 1993 and 1997 | IAP 2060 Target-Date Fund | 2058-2062 |

| Between 1998 and 2002 | IAP 2065 Target-Date Fund | 2063-2067 |

| In 2003 or later | IAP 2070 Target-Date Fund | 2068 or later |

*These “target dates” do not dictate when you have to or will be eligible to retire.

Target-date fund shifts

Every five years, a new TDF will be added for younger public employees. At the same time, the most mature of the TDFs — the one below the Retirement Allocation Fund (RAF) — will move into the RAF.

These shifts are part of a regular process that began in 2020.

Shifting the TDFs helps to keep the IAP's age-based investment strategy effective by creating a fund for younger workers entering the PERS system and moving the TDF of employees near retirement into a fund with less volatile investments.

Read more about these shifts on our Individual Account Program target-date fund shifts webpage.

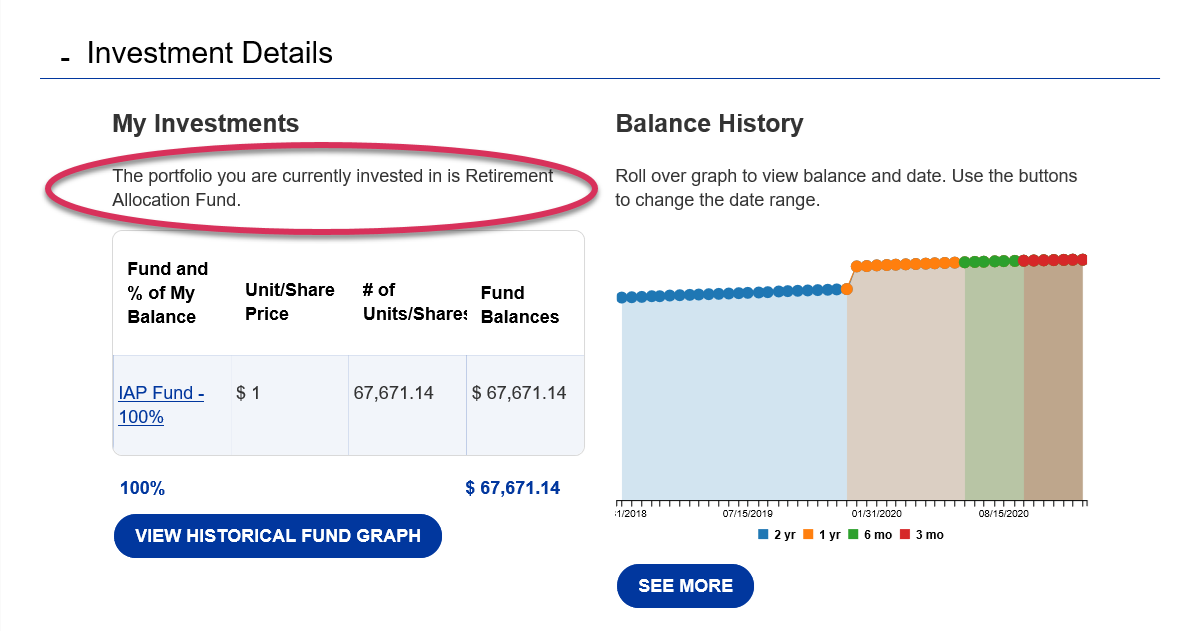

How can I confirm my current IAP TDF?

You can view your current TDF information by logging into your

IAP account, where it is identified as the “portfolio you are currently invested in” under “My Investments” on your account homepage.

Can I change the IAP TDF in which I am invested?

Yes. Each September, members who have not retired from their IAP can make what is called a “Member Choice election," which allows you to pick a TDF for the upcoming year that better reflects your retirement savings goals or your personal risk tolerance.

Read

step-by-step instructions about how to choose a different TDF in Online Member Services (OMS) for the upcoming calendar year.

If you make a choice, you are required to certify that you have visited

Treasury's IAP website to learn about the OIC's IAP TDF investment strategy and considered the risk and return characteristics of your IAP TDF. To learn more about target-date funds, the investments in each fund, and their risks, read Oregon State Treasury's

Understanding IAP Target-Date Funds and Member Choice document. You are required to read this document if you make a Member Choice election.

Note that any valid election you make will

not go into effect until January 1 of the following year, which means you will not see annual investment returns reflected on your member annual statement until spring the year after that. For example, if you made an election in 2020, it went into effect January 1, 2021. While you will see the election noted on your 2020 statement, you will not see earnings based on that election until you get your 2021 statement, which will be mailed in spring 2022. You can change your TDF only

once per calendar year.

Each year, Member Choice is optional. You do not have to take any action. If you do nothing, you will continue to be invested in your current TDF.

Member Choice has the following limitations:

- Only

members who have

not retired from their IAP can change their TDF. If you have already retired or withdrawn your IAP, Member Choice does not apply to you.

- Also ineligible for Member Choice are: alternate payees, beneficiaries, public employees who have not yet completed their six-month waiting period to establish PERS membership, and members who have already withdrawn or distributed their IAP balance.

- Member Choice elections made through

Online Member Services (OMS) can

only be done during September of each year, and are a one-time, irrevocable election.

- Elections made using a

paper form can be submitted from January through September 30 of each year.

- Pay close attention to the instructions on the

paper form if you choose this option instead of OMS. Forms must be

received by PERS by September 30 to be effective January 1 of the following calendar year. In addition, if more than one TDF election is submitted to PERS, whether by the form or through OMS, only the first election received by PERS will be deemed valid.

- Note that members who retired their pension before 2011 but have not retired or withdrawn their IAP will need to use the

paper form to make a Member Choice election.

-

You can change your TDF only once per calendar year. The choice is irrevocable and cannot be canceled.

- Your choice will remain in effect unless you make a new election during a subsequent year's election window. For example, that means if you changed your TDF in 2020 (to be effective in 2021), you cannot reverse the change nor make a new election until the Member Choice window opens again in 2021, which will be for choices effective in 2022. Once you make a Member Choice election, your election will remain in force until you make a new election.

- Find full rules in Oregon Administrative Rule

459-080-0015.

Sign up for GovDelivery updates on this topic to receive alerts in the future.

When do I receive earnings for my IAP TDF?

As a non-retired member, you can see your ongoing payroll contributions to your IAP when you log into your

t (note that rep orting delays from your employer to PERS to Voya mean your account balance may not always be up-to-date).

However, PERS only credits IAP TDF earnings to non-retired members’ IAP accounts on an annual basis. This is so your PERS-participating employer has time to accurately submit member and employer contributions to PERS and thus members are not adversely impacted by posting delays or corrections.

The PERS Board credits earnings to IAP accounts for the

previo us year, based on your account balance as of December 31, in late March or early April. You will see this information on your

member annual statement each spring.

Unless you retire or withdraw your IAP account, your IAP will continue to receive annual earnings determined by the performance of your IAP TDF each calendar year.

The latest year-to-date earnings available for crediting for non-retired members are listed below but are for informational purposes only. Non-retired members only receive annual earnings based on the “final” rate, each calendar year, unless you retire or withdraw.

Latest IAP earnings

IAP Target-date Funds:

Latest Year-To-Date Earnings (2025)

Earnings available as of the end of

| January | February | March | April | May

| June | July | August | September | October | November | December | 2025 Final Earnings Credited |

|---|

Retirement Allocation Fund

| 1.01%

| 2.37%

| 2.76%

| | | | | | | | | | |

|---|

2030

| 1.08%

| 1.87%

| 1.64%

| | | | | | | | | | |

|---|

2035

| 1.14%

| 1.71%

| 1.36%

| | | | | | | | | | |

|---|

2040

| 1.39%

| 1.72%

| 0.97%

| | | | | | | | | | |

|---|

2045

| 1.44%

| 1.74%

| 0.99%

| | | | | | | | | | |

|---|

2050

| 1.42%

| 1.74%

| 1.02%

| | | | | | | | | | |

|---|

2055

| 1.38%

| 1.70%

| 1.03%

| | | | | | | | | | |

|---|

2060

| 1.30%

| 1.61%

| 0.96%

| | | | | | | | | | |

|---|

2065

| 1.24%

| 1.54%

| 0.93%

| | | | | | | | | | |

|---|

2070

| 1.25%

| 1.52%

| 0.83%

| | | | | | | | |

| |

|---|

- Note: PERS credits each IAP TDF (the entire fund) with earnings on a monthly basis (see table for monthly earnings rates). However, individual accounts for members

who have not yet retired will only

see IAP TDF earnings credited on an annual

basis, using the “final” rate for the year. Monthly rates are not applied to non-retired individual member accounts.

- The latest year-to-date rates (see table) are only directly allocated to 1) retirees who elect to receive a lump-sum payment (or rollover) of their IAP account at retirement or 2) to members who elect to withdraw their IAP accounts.

- Earnings are credited based on the latest monthly year-to-date calculation available and may differ from investment returns reported by the Oregon State Treasury. This is due to administrative expenses and reserving requirements provided in statutes, administrative rules, and PERS Board actions. Full information can be found in OAR

459-080-0200 and OAR

459-007-0320.

If you are a retiree currently receiving IAP installment payments, see the

Financials – IAP Installment Payments webpage for information about the earnings rates used to credit your IAP installment account.

Previous IAP earnings

In compliance with the Americans with Disabilities Act (ADA), PERS will provide documents on this page in an alternate format upon request. To request a document in an alternate format, call 888-320-7377 (toll free) or TTY 503-603-7766.