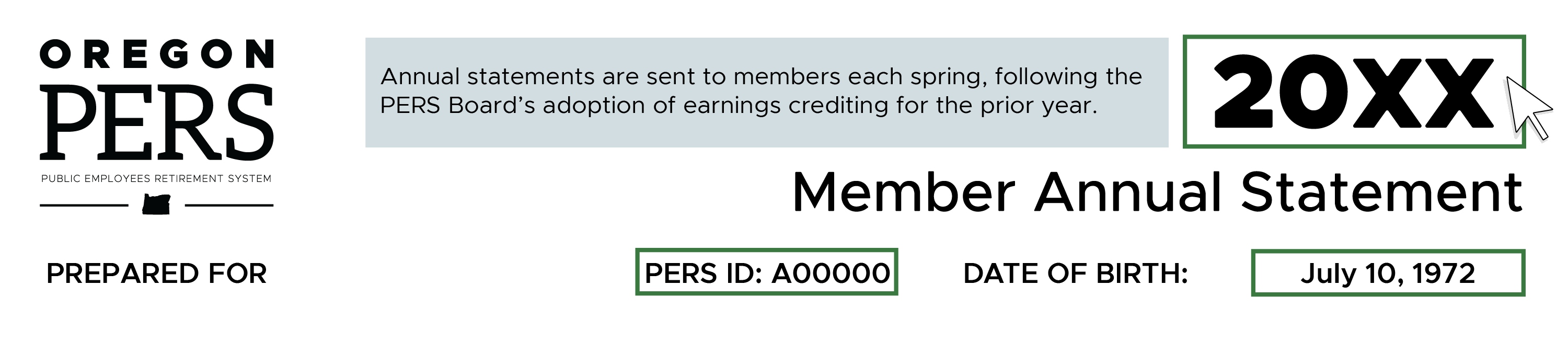

This year’s member annual statements, reflecting information through December 31 of the preceding year, will be

mailed in May of this year. The information below will be updated each year to reflect the most current annual

statement information.

Annual statement information for all members

All PERS members who have worked in a qualifying position since January 1, 2004, have

two parts to their PERS retirement:

A

pension — Tier One, Tier Two, or Oregon Public Service Retirement Plan (OPSRP)

An Individual Account Program (IAP) account

The member annual statement you receive each year will include important details about both

benefits, based on information submitted by your employer and

annual earnings credited as of December 31 of the

prior year. Check that your date of birth and other personal information is correct. If not, contact your employer.

Note that statements pull data such as service credit, hours worked, and salary information reported by your employer

throughout the years. Other relevant information may not be reported until you separate from all PERS-covered

employment.

When you apply to retire, PERS will thoroughly review and verify all of your member information. If errors or

discrepancies are found, your benefit will be adjusted accordingly. As such, this review process may produce a final

benefit amount that differs from what appeared in any benefit estimates you request from PERS, whether through Online

Member Services or in writing.

For more details about benefit estimates, read our

Benefits Estimates webpage.

Want to know more about your retirement program?

PERS offers:

-

Online access to your

PERS

and

IAP

accounts. Remember: The online portal to your IAP is administered by PERS’ third-party administrator, Voya, and

requires additional steps before you log on. More details are available on our

IAP account log-on information webpage.

-

Member news and information via email or text alerts through

GovDelivery

Membership-specific FAQs and interactive example statements, by statement type

Interactive example statements work best by downloading the PDF to your computer. You can hover over any piece of

data outlined in green to read tips and more information (requires an up-to-date version of Adobe Acrobat

Reader).

| Tier One/Tier Two (hired before August 29, 2003) |

Tier One/Tier Two FAQ

|

Tier One Interactive Example

Statement

(hired before January 1, 1996)

Tier Two Interactive Example Statement

(hired on or after January 1, 1996, and

before August 29, 2003)

Tier

Two "Zero Dollar Balance" Interactive Example Statement

(Certain Tier Two members who

were generally hired in the six months before August 29, 2003, are Tier Two members but do not have a Tier

Two account balance. Their contributions began after January 1, 2004, when contributions only went into the

IAP.)

|

| OPSRP (hired after August 28, 2003) |

OPSRP FAQ

|

OPSRP Interactive Example Statement

|

Police Officer & Firefighter Units

(Tier One/Tier Two only)

|

P&F FAQ

| |

IAP Only

[Members who retired or withdrew their

pension but not their IAP (before 2011) or only have IAP for other reasons]

|

IAP FAQ

| |

Alternate Payee

(Divorce-related accounts) |

AP FAQ

| |

| Judge Members |

Judge FAQ

| |

Loss of Membership

|

LOM FAQ

| |

In compliance with the Americans with Disabilities Act (ADA), PERS will provide PDF documents on this page in

an alternate format upon request. To request a document in an alternate format, call 888-320-7377 (toll free) or

TTY 503-603-7766.

Page updated April 2021