Overview

When you, an employer, make a lump-sum payment to prepay all or part of your pension unfunded actuarial liability

(UAL), the money is placed in a special account called a “side account.” This account is attributed solely to the

employer making the payment and is held separate from other employer reserves. The money is invested in the

Oregon Public Employees Retirement Fund

(OPERF) and is subject to earnings and losses.

Opening a new side account

Benefits of a side account

Side accounts increase an employer's actuarial assets, reducing the gap between actuarial assets and actuarial

liabilities. When liabilities exceed assets, this becomes a UAL. (To learn more about UAL, read “Guide to Understanding UAL.”)

Establishing a side account reduces your pension obligation, which reduces your employer contributions and rates

over time.

How to establish a side account

If you are interested in establishing a side account or have additional questions, please email

PERS Actuarial Services.

Employers have two options for establishing a side account:

- Request an actuarial calculation.

Requesting an actuarial calculation allows for an immediate rate offset. Employers can select the

first of any month within a rolling 12-month period for their rate to begin.

An actuarial calculation costs $1,000 for one date and one payment amount. Each additional date,

payment amount, or amortization schedule (if applicable) is an additional $250.00.

- Receive the rate offset effective July 1, following the publication of the actuarial valuation of that year.

How the side account offset rate is calculated

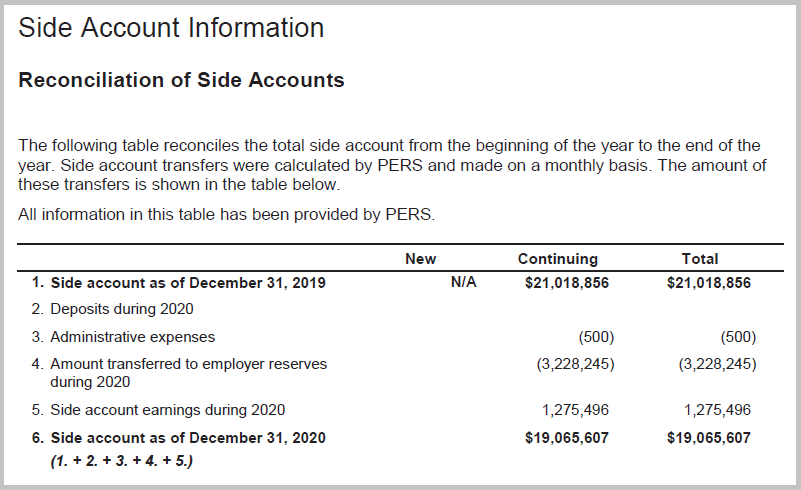

The side account rate offset is recalculated during each biennial rate-setting actuarial valuation. The new side

account amount is determined by deducting the money that was transferred to the employer's reserves to reduce

their monthly statement (along with the annual maintenance fee). The gains or losses are added to the total side

account amount. This information is available in your actuarial valuation.

Example from an actuarial valuation.

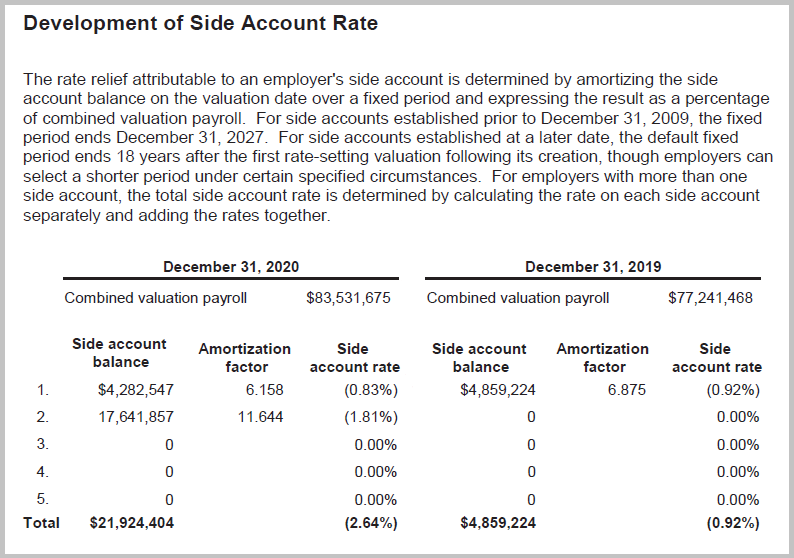

Once the new side account amount is established, the PERS consulting actuaries use the formula below to calculate

the new side account rate offset:

Total lump sum ÷ combined valuation payroll ÷ amortization factor =

Side account rate offset

Example from an actuarial valuation.

To estimate the effect of a side account, please use the

Employer Rate Projection Tool.

Administrative fees

Side accounts are charged an annual fee for their administration. The fee is $1,500 in the first year and $500

each subsequent year. The fee is automatically taken out of your side account when earnings are applied.

An actuarial calculation costs $1,000 for one date and one payment amount. Each additional date, payment amount,

or amortization schedule (if applicable) is an additional $250.00.

Amortization options

Side accounts are typically amortized over 20 years. However, as established with

Senate Bill 1566 (2018) and Senate Bill 1049

(2019), employers making a lump-sum payment of at least $10 million can elect an amortization period of 6

years, 10 years, 16 years, or 20 years. They can also choose to defer their rate offset date beyond the standard

rolling 12 months. These amortization options require an actuarial calculation.

Side accounts for pool members

Although employer rates are set at a pool level, employers have the option to establish a side account to

differentiate their individual rate.

For State and Local Government Rate Pool (SLGRP) employers: The supplemental payment is first

applied toward your transitional liability, if you have any, and the rest is placed in a side account.

For School District Pool members: Once you create a side account, you start to receive your own

valuation, which contains full details on how the side account rate is calculated and the amount in the side

account. Additionally, the valuation contains information that is specific to you, the employer, including

combined valuation payroll and the UAL allocated to the employer from the pool.

Expiration of side accounts

Expiration of side accounts in 2027

More than half of employer side accounts (52%) are scheduled to fully amortize on December 31, 2027.

The PERS Actuarial Team has formulated two options employers can use to handle the expiration of their side

accounts. The two options are designed to ensure that employers receive the full actuarial value of their side

account(s) while protecting employers from:

- Cash-flow concerns for those using pension obligation bonds.

- Challenges implementing mid-biennium rate changes.

- The risk of “over withdrawing” side account balances.

This information is covered in more detail in the

October 2024 Employer

Advisory Group meeting handout, slides 22 through 25.

OPTION 1 — Converting the balance into a new side account

In April 2027, the PERS Actuarial Team will calculate the employer’s side account balance as of December 31, 2026

(including earnings).

The employer will have the option to convert the residual balance into a new side account, provided that:

- The December 31, 2026, side account balance is at least $500,000.

- The employer notifies PERS of this intention on or before May 31, 2027.

The new side account deposit amount and rate offset will be communicated to the employer on November 1, 2027.

The new offset rate will be effective January 1, 2028.

OPTION 2 — Converting the balance into account credit

In this option, the side account’s balance is applied to the employer’s contribution account as a credit rather

than as a rate offset. This occurs twice:

- On June 30, 2027 — one credit of 30% of the side account’s calculated balance as of December 31, 2026.

- On November 1, 2027 — a second credit for the remaining side account balance (less the 30% deducted in June

2027).

Credit is applied to the employer’s PERS liabilities until it is spent. The side account closes on December 31,

2027.

Side account reports

Number of employers with side accounts (as of December 31, 2023, valuation)

As shown in the table below, 232 employers have established side accounts.

| Employer type | Number of employers with

side accounts |

| State agencies (all, including Oregon University System) | 5* |

| Pooled cities | 29 |

| Pooled community colleges | 17 |

| Pooled counties | 16 |

| Pooled special districts | 24 |

| School Districts Pool | 125 |

| Independent locals (not a member of a pool) | 16 |

State agencies share a single side account. In addition to this side account, four state agencies have

established individual side accounts.

Number of employers with more than one side account (as of December 31, 2023)

There are no restrictions on the number of side accounts an employer may have.

As of December 31, 2023, 88 employers have more than one side account; 24 employers have three or more side

accounts

| Employer type | Number of employers with multiple side accounts

|

| State agencies (all, including Oregon University System) | 4 |

| Pooled cities | 4 |

| Pooled community colleges | 7 |

| Pooled counties | 5 |

| Pooled special districts | 6 |

| School Districts Pool | 56 |

| Independent locals (not a member of a pool) | 6 |

Side account assets (as of December 31, 2023)

Side account assets totals, by type of employer.

Employer type

| Total side account assets |

| State agencies* | $1,004,033,869 |

| Pooled cities | $63,806,697 |

Pooled community colleges

| $662,646,168 |

Pooled counties

| $237,661,838 |

| Pooled special districts | $199,361,257 |

School Districts Pool

| $2,870,121,406 |

| State and Local Government Rate Pool | $2,167,509,829 |

| Independent locals (not a member of a pool) | $376,605,870 |

*Includes individual side accounts for OSU, SAIF, U of O, and the State Bar Professional Liability Fund

Side account summaries by year

2023 summary

2022 summary

2021 summary

2020 summary

2019 summary

2018 summary

2017 summary

Average earnings by year (from 2007 to 2023)

Side accounts are invested in the PERS Fund and receive the fund's actual earnings or losses. These earnings or

losses are posted to side accounts at the end of each year.

| Calendar year | Average earnings/losses |

| 2007 | 10.22% |

| 2008 | –27.83% |

| 2009 | 19.52% |

| 2010 | 13.13% |

| 2011 | 2.96% |

| 2012 | 15.39% |

| 2013 | 16.67% |

| 2014 | 7.79% |

| 2015 | 2.25% |

| 2016 | 7.65% |

| 2017 | 16.71% |

| 2018 | 0.56% |

| 2019 | 13.92% |

| 2020 | 7.18% |

| 2021 | 18.93% |

| 2022 | -1.85% |

| 2023 | 6.34% |

Note: These rates are calculated based on the total side accounts balance less administrative

fees.

Pension obligation bonds

Pension obligation bond (POB) requirements

Before issuing a bond

Senate Bill 1049 (2019) expanded the guidelines for employers funding side accounts with pension obligation bonds.

Before issuing a POB, an employer must obtain and submit an assessment as follows:

You must obtain a

statistically based assessment from an independent economic or financial consulting firm to

assess the likelihood that the investment returns on bond proceeds will exceed the interest cost of the

bonds under various conditions.

You must give the assessment to the

state treasurer at least 30 days before issuing the bonds.

You must make a

report available to the public that describes the results of that assessment and discloses

whether you retained the services of an independent SEC-registered advisor.

After issuing a bond

Employers are required to report the following to the state treasurer by December 1 every year.

Other considerations

Pension obligation bond rates of return

To assist employers with this required reporting, PERS is providing the average rate of return for side accounts

in the previous year and the cumulative rate of return as of the current year.

| Year pension obligation bond was established | Actual rate of return on proceeds in previous year | Cumulative rate of return |

| 2019 | 6.34%

| 51.57% |

2020

| 6.34% | 33.05% |

2021

| 6.34%

| 24.14% |

| 2022 | 6.34%

| 4.38%

|

| 2023 | 6.34% | 6.34% |

| 2024 | N/A | N/A |

| Year | Year-to-date average final crediting rate for side accounts |

| 2019 | 13.92% |

| 2020 | 7.18% |

| 2021 | 18.93% |

| 2022 | -1.85% |

| 2023 | 6.34% |

Information and assistance

Contact us

If you're interested in establishing a side account or have additional questions, please email

PERS Actuarial Services.