By joining PERS, you join more than 900 other Oregon employers who offer their employees an excellent retirement program as part of the total employee benefit package.

The Oregon Public Employees Retirement System (PERS) is a retirement program offered exclusively to Oregon’s public employers. All Oregon public schools, charter schools, community colleges, state universities, and state agencies automatically participate in PERS. Local governmental entities such as cities, towns, counties, fire districts, health districts, utility districts, library districts, housing authorities, and ports are also welcome to join PERS.

-

Monthly pension payments for your qualifying employees for life (employees must work at least 600

hours a year to qualify for benefits). Depending on how long they work and the kind of work they do, their

retirement pay can equal up to about 45% of their salary.

-

An Individual Account Program (IAP) retirement account funded through monthly deductions of 6%*

of an employee’s salary. The 6% payment can be paid by the employee (either pre-tax or after tax) or covered by

the employer. At retirement, employees can receive their IAP on a monthly, quarterly, semi-annual, or annual

disbursement schedule. They can also choose to receive it as a lump sum or IRA rollover.

- The option to contribute pre-tax to a deferred compensation retirement account, called

Oregon Savings Growth Plan, if the employer elects to participate in that optional 457(b) plan.

- The option to have partially subsidized health insurance after retirement, called the

PERS Health Insurance Plan (PHIP).

*Not all employees receive the full 6% in their IAP account each month. Employees who earn over a certain

amount have a portion of the 6% deposited into another account called their Employee Pension Stability Account

(EPSA). The funds in that account are used to pay for the employee’s pension when they retire.

-

The Oregon Legislature decides the benefits and rules of the plan.

-

The Oregon Treasury and Oregon Investment Council manage and invest the funds.

-

PERS-participating employers are the main funding source for PERS. They use the online reporting

system Employer Data Exchange (EDX) to submit job status, salary, hours, and other data about employees to PERS on

a regular basis. They pay for PERS by sending payments through Automated Clearing House (ACH).

-

The PERS agency runs the program in accordance with the laws passed by the Legislature; sets

employers’ rates, as determined by a consulting actuary; collects payments from employers; and disburses

retirement checks to retirees and beneficiaries.

What you will pay to PERS to fund your employees’ future retirement benefits depends on several factors. Generally,

most employers’ rates are about 10% of the salaries they pay to employees who qualify for PERS (i.e., employers who

employ mostly OPSRP members). To learn more about how your rate is determined, read

Guide to Understanding Your Rate.

A. For educational employers and state agencies

- Contact the PERS Employer Service Center (ESC).

By email: ESC representatives are available to answer emailed questions Monday to Friday from

8 a.m. to 5 p.m. Email your assigned representative directly or the

Employer Support inbox. Most emails are answered within

24 hours.

By phone: ESC representatives are available to assist by phone Monday to Friday. Call your

assigned representative’s direct phone line between 8:00 a.m. to 4:00 p.m. or the Employer Call Center line

between 8:30 a.m. to 12:00 p.m. at 888-320-7377.

- ESC will open a file for your organization and assign you an employer number. They will send you the Employer

Data form (#459-261) to complete.

- Fill out the Employer Data form as explained below in “Filling Out the Employer Data

Form.”

- Mail the completed and signed form to the PERS mailing address at the top of the form. Include one or both of

the following documents:

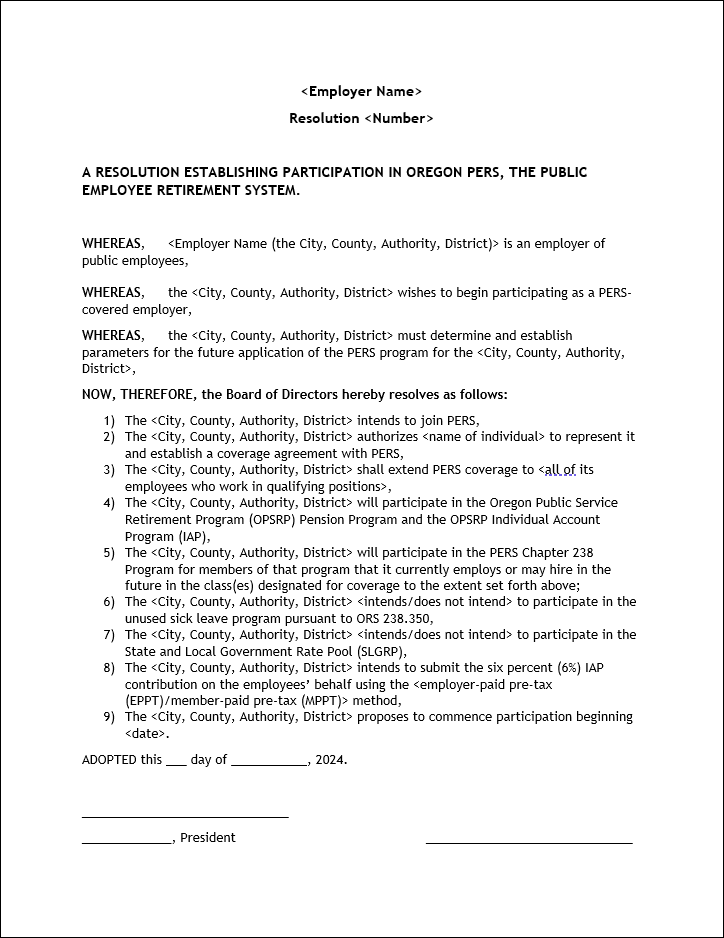

B. For local governmental entities

A local governmental entity must enter into a written PERS coverage agreement before it may begin participating

in PERS. The local government must first submit a signed resolution from its governing board and that

resolution must set forth various elections.

A sample board resolution is shown at the bottom of this webpage.

- After a coverage agreement is signed by the necessary parties, ESC will open a file for your organization and

assign you an employer number. They will send you the Employer Data form (#459-261) to complete.

- Fill out the Employer Data form as explained below in “Filling Out the Employer Data

Form.”

Choices and responsibilities after joining

Employers participating in PERS are required to:

- Continue to be participating public employers for the purpose of the Oregon Public Service Retirement Plan (PERS).

- Participate in the Individual Account Program (IAP).

- Provide benefits under the pension program established under

ORS 238A.100 to 238A.250 for eligible employees who are members of the pension program.

- Fund the pension benefits for eligible employees who are members of the pension program.

- Remit information and payments on time.

Most PERS-participating employers are grouped into pools to share costs. Employers in a pool jointly fund the future pension costs of all pool participants. Pool members also share a percentage of the pool’s liabilities and pay them off as a group. By sharing liabilities, pool members have a more stable contribution rate. There are three pools:

The State and Local Government Rate Pool (SLGRP).

Any PERS-participating employer (other than a school district) can join the SLGRP. The SLGRP is the state’s largest pool. Membership is optional.

Membership in the SLGRP is explained in detail in the

Guide to Understanding Pooling: SLGRP. The School Districts Pool.

The state’s second-largest pool consists of all K–12 school districts in the state. Membership is mandatory.

Membership in the School Districts Pool is explained in detail in the

Guide to Understanding Pooling: School Districts Pool.

Independent employers.

These are the employers who are not pooled. They are grouped together for valuation reporting, but they do not share costs.

Read the

Guide to Understanding Pooling: SLGRP to learn about system-wide pools in which all employers participate.

Every PERS-participating employer must assign two roles to manage their PERS account. The responsibilities of these roles are discussed in

employer reporting guide 3

Reporter Roles and EDX Access.

-

Web administrator. This role manages access to the account.

-

Employer reporter. This role reports employee wages, hours worked, demographic information, work status, job type, and more to PERS through the Employer Data Exchange (EDX) web tool. Each employer can have up to 15 employer reporters who use EDX.

In addition to the two roles above, your EDX account must include contact information for people who are authorized to discuss your account with PERS. The web administrator is responsible for filling in contact information for the following roles:

-

Reporting official — Typically the head of the agency/organization or someone responsible for making financial decisions.

-

Personnel — Typically the PERS contact in the Human Resources department.

-

Payroll — Typically the PERS contact in the Payroll department.

-

Other — Anyone else an employer wants to list as a contact.

-

Complete the agreement form

To sign up for ACH, complete the

PERS Employer: Automated Clearing House (ACH) Agreement form.

Once completed, mail the form to:

PERS

attn: Employer Service Center

PO Box 23700

Tigard, OR 97281-3700 -

Choose debit or credit

ACH debit (pull) (preferred)

PERS deducts or “pulls” payments from the bank account you designate. Neither PERS nor the state of Oregon charge transaction fees for this service.

ACH credit (push)

Your organization initiates or “pushes” the payment of funds from your bank to the account PERS designates. You need to work with your financial institutions before initiating ACH credit transactions.

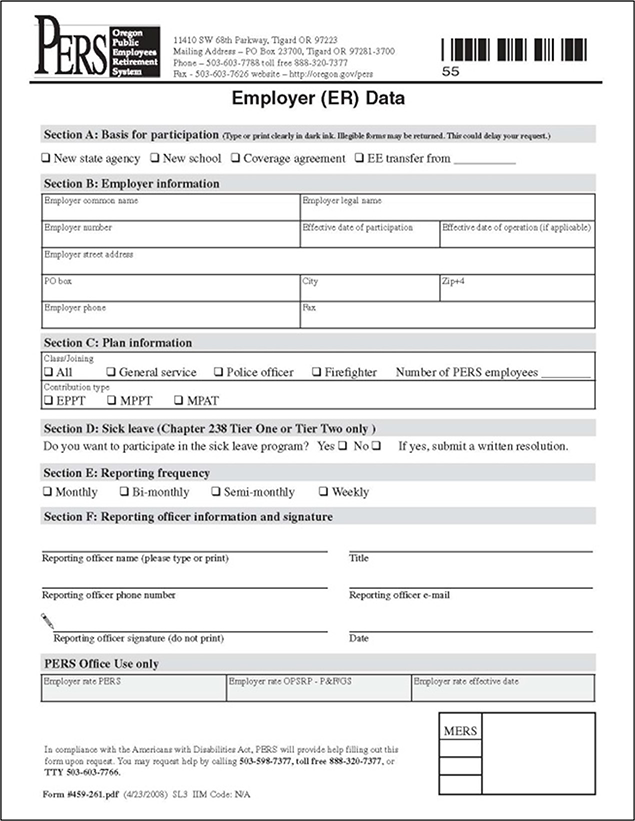

Section A: Basis for participation

This section is asking your reason for joining PERS. Is your organization new or do you have a new collective bargaining agreement?

- “EE transfer from” is only checked when employees from one public employer are transferring to another public employer that participates in PERS. In this situation, the employer is sent an Employee Transfer form from PERS, which commits them to participating only in PERS for 12 months.

Section B: Employer information

ESC will provide your employer number and effective date of participation. -

Section C: Plan information

- Class/Joining: This section is asking what kind of jobs your employees do, called their job classification.

- Check the Police or Firefighter box if you have police or fire employees.

- Check the General Service box for other types of employees who are not police officers or firefighters.

- Check All if you have school employees.

- Number of PERS employees: Number of employees you currently have.

Contribution type

This is asking how you want to submit your employee’s 6% Individual Account Program (IAP) contribution

Employer-paid pre-tax (EPPT).

Employers may increase their employees’ salaries by 6% to cover the pre-tax IAP contribution.

Participation in EPPT requires an employer to:

- Have a written employment policy or agreement stipulating an EPPT contribution type (a collective bargaining agreement or resolution).

- Agree to pay EPPT contributions for all employees within a classification.

- Contribute the full 6% contribution.

Member paid pre-tax (MPPT).

Employers selecting MPPT deduct the 6% contribution from their employees’ (i.e., the PERS member) salary prior to calculating the tax deduction.

If your organization chooses MPPT, state the following in your resolution :

- Employees do not have the option of receiving the salary payment and paying the PERS employee contribution directly.

- An employee’s reported salary on the W-2 form for tax purposes will be reduced by the amount of the employee’s contributions.

Member Paid After-Tax.

You can also decide to deduct the 6% contribution from employees’ wages after all taxes are deducted.

Section D: Sick leave (Chapter 238 Tier One or Tier Two only)

This section is asking if you want to participate in the unused sick leave program. The program is only available to existing PERS members who are in the Tier One or Tier Two plan. The program applies a portion of these members’ unused sick leave hours toward their retirement pension amount. Participation in the unused sick leave program may negligibly increase your employer rate if you are not a pooled employer.

Your employees who have never been members of PERS will be members of the Oregon Public Employees Retirement Plan (OPSRP), which does not give members any credit for their unused sick leave at termination or retirement. Only members of the PERS Tier One or Tier Two plan get credit for their unused sick leave.

If you choose to participate in the unused sick leave program, you will need to calculate and report unused sick leave hours for your Tier One or Tier Two employee upon termination (i.e., they quit, get fired, or get laid off) or retirement.

To participate, in addition to checking the box in section D on the Employer Data form, send PERS a signed copy of your governing board’s decision to participate in the program. A sample of a board resolution is shown at the bottom of this webpage.

Section E: Reporting frequency.

This is how often you will report your employees’ wages and hours to PERS. Select a frequency that most closely matches your payroll cycle.

|

Monthly | Reports due the last day of the month. |

|

Bi-monthly | Reports due every other Friday. |

|

Semi-monthly | Reports due the 15th and last day of the month. |

|

Weekly | Reports due every Friday. |

Section F: Reporting officer information and signature.

Include the information and signature of someone at your organization who has financial authority, such as your chief financial officer, chief executive officer, or school principal.

Employer Data form

Fictional sample of resolution to establish PERS coverage