PERS is directed to increase benefits for certain Tier One members* to compensate for state income taxation on PERS

benefits. Each year, PERS works with the Oregon Department of Revenue (DOR) to determine residency based on income

tax returns for the previous year. Having an Oregon address of record with PERS

does not satisfy residency certification requirements. Frequently asked questions about tax remedy are

available

here.

Retirees can confirm or update their residency status at any time through

Online Member Services

(OMS). Step-by-step information on how to certify your residency status in OMS is available below.

If you cannot provide electronic residency certification using OMS, please complete and submit a

PERS Residency Status

Certification form.

PERS must receive your certification by December 15 in any calendar year to ensure the “tax remedy”

you are eligible for will be included in your benefit payments in the upcoming year.

(*Tier One members who are Oregon residents for the purpose of paying Oregon income taxes, were hired before

July 14, 1995, and have either service time before October 1, 1991, or at least 10 years of creditable service,

are eligible for the “tax remedy.”)

Log on to

OMS.

If you do not have an existing OMS account, you can click on Open a New Account on the Log In

page or

click

here. Once you have created your account, use your new User ID and Password to complete the log on process.

After you log on, click on the link under Account Type. This will bring you to your

Account Summary page.

On the Account Summary page, you can confirm your existing Residency and Residency Effective Date (if

applicable) on file.

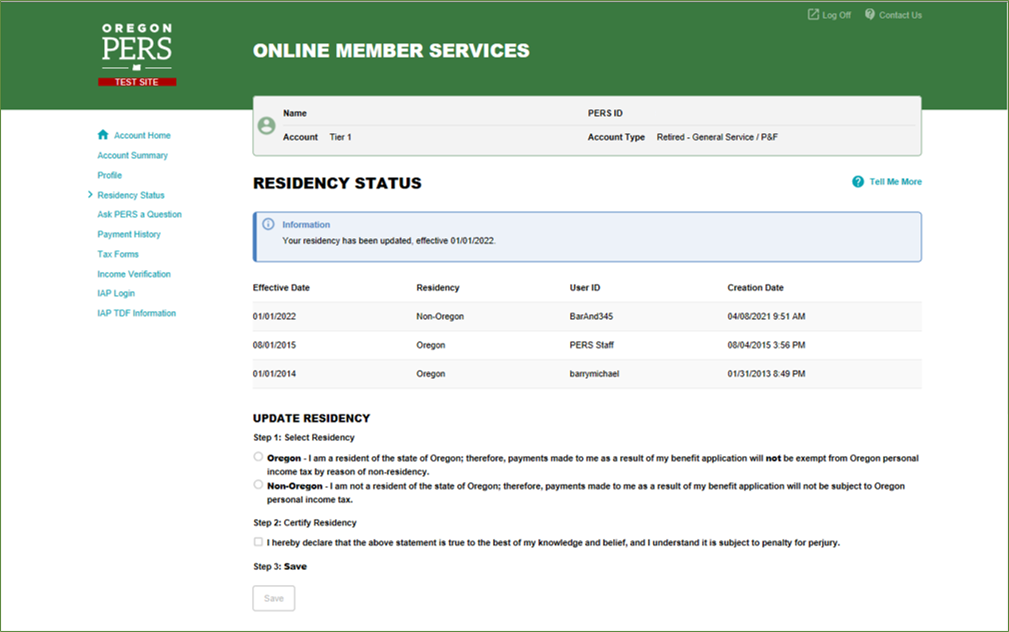

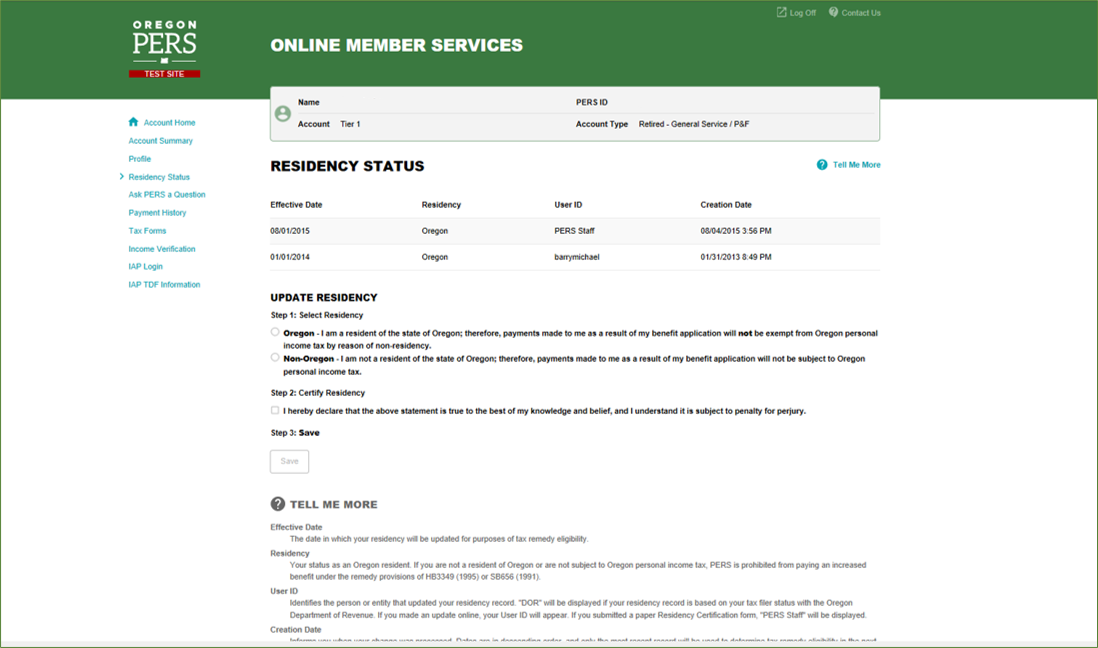

Click on the Residency Status link on the left-hand side of the page.

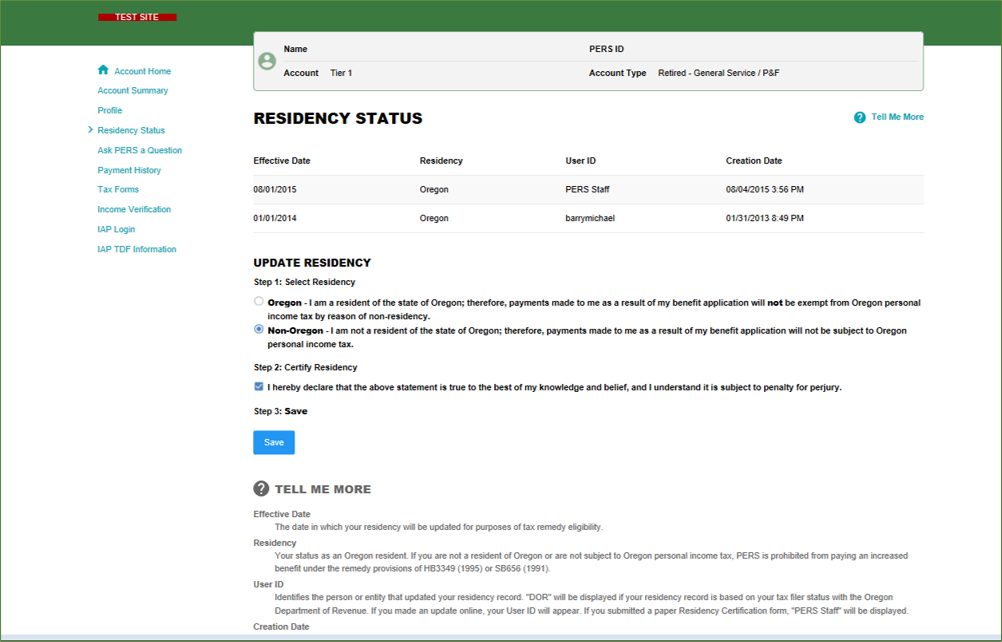

The Update Residency page allows you to certify your residency status. Select one of the boxes in Step

1 and check the box in Step 2. Click Save to confirm your selections.

Glossary:

-

Effective Date – The date in which your residency will be updated for purposes of tax remedy

eligibility.

-

Residency – Your status as an Oregon resident. If you are not an Oregon resident or are not

subject to Oregon personal income tax, PERS is prohibited from paying an increased benefit under the remedy

provisions of Senate Bill 656 (1991) or House Bill 3349 (1995).

-

User ID – Identifies the person or entity that updated your residency record. “DOR” will be

displayed if your residency record is based on your tax filer status with the Oregon Department of Revenue

(DOR). If you made an update online, your User ID will appear. If you submitted a PERS Residency Status

Certification form, “PERS Staff” will be displayed.

-

Creation Date – Informs you when your change was processed. Dates are in descending order, and

only the most recent record will be used to determine tax remedy eligibility in the next calendar year.

A message box will appear confirming that your residency has been updated. Residency certification updates become

effective on one of these dates:

-

January 1 of the upcoming year, if residency is updated by December of the current year.

OR

-

The first day of the calendar month following your update, if updated by PERS between January 1 and April 15.

OR

-

January 1 of the following year, if updated on or after April 16.