How you are invoiced

Every weeknight between 9 p.m. and 6 a.m. Pacific Time (except holidays), the PERS EDX system processes the employer reports you released. EDX takes the wages you reported and multiplies them by your employer contribution rate to calculate what you owe. It then posts detailed invoices to your employer statement in EDX.

When you are invoiced

Invoices gather in your Unbilled Activity list between statement dates. On your statement date, unbilled activity moves to your remittance statement.

EDX creates remittance statements on the 5th and 20th of each month (or prior business day if either date falls on a weekend or holiday).

- Records that posted from the 21st of the previous month to the 5th of the current month will appear on the remittance statement generated on the 5th; records that posted from the 6th to the 20th will appear on the remittance statement generated on the 20th.

- EDX creates statements on the 5th and the 20th even if no wage and contribution or other invoices exist.

- Records from multiple reports may post in the same batch; a statement may contain activity from multiple reports.

Viewing your invoice

To see your invoice, select View Your Statement from the main EDX Site Navigation menu.

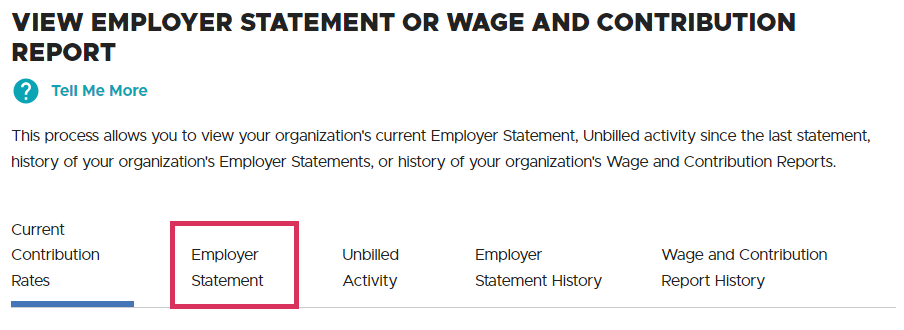

On the View Employer Statement or Wage and Contribution Report screen, click Employer Statement.

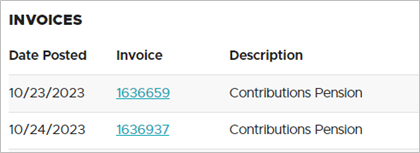

Your statement includes invoices for all the different types of charges in your statement. Click the linked invoice number to open the invoice.

Your contribution rate

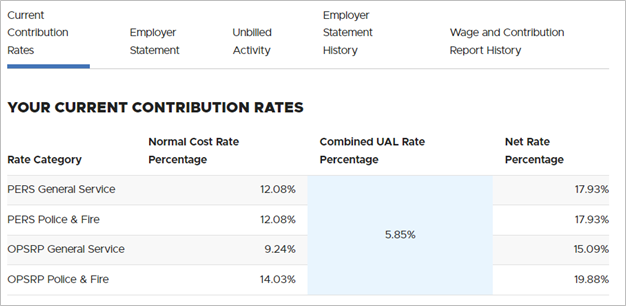

On the View Employer Statement or Wage and Contribution Report screen under Current Contribution Rates, you can view the rate you are paying for employees in the three PERS plans — Tier One and Tier Two (called “PERS") and the Oregon Public Service Retirement Plan (OPSRP) — as shown in the sample screen below.

Understanding your statement

Read

employer reporting guide 26,

Understanding Your Statement.

Paying your invoice

Read

employer reporting guide 27,

Paying Your Invoice.